Professional illustration about Coins

Gold Coin Basics

Gold Coin Basics

When it comes to precious metals investing, gold coins are one of the most accessible and tangible ways to diversify your investment portfolio. Unlike stocks or bonds, physical gold offers a sense of security, especially during economic uncertainty. The gold spot price fluctuates daily, but owning bullion coins from reputable mints like the US Mint, Canadian Royal Mint, or Perth Mint ensures you’re holding a globally recognized asset.

Popular gold bullion coins include the American Gold Eagle, American Buffalo, and Canadian Maple Leaf, all of which are IRA eligible, making them a smart choice for those considering an IRA rollover. The American Eagle Proof Coins are particularly sought after by collectors for their stunning finishes and limited mintages. Internationally, options like the Gold Krugerrand (South Africa), Britannia (UK), and Philharmonic (Austria) are also highly liquid and trusted. Private refiners like PAMP Suisse produce high-quality bars and coins, often featuring intricate designs that appeal to both investors and collectors.

For beginners, understanding the difference between bullion coins (valued primarily for their metal content) and numismatic coins (valued for rarity/condition) is crucial. Bullion coins like the Maple Leaf or Krugerrand are minted with .9999 fine gold, ensuring purity, while older or rare coins may carry premiums beyond the gold standard. Storage is another key consideration—secure storage options include home safes, bank deposit boxes, or specialized vaulting services.

Diversifying with gold investment isn’t just about buying the shiniest option; it’s about strategy. For example, smaller denominations (like 1/10 oz coins) offer flexibility for liquidation, while larger bars or coins may provide cost efficiencies. Always verify authenticity by purchasing from accredited dealers, and stay updated on market trends to time your acquisitions wisely. Whether you’re hedging against inflation or building a long-term precious metals reserve, gold coins remain a cornerstone of portfolio diversification.

Professional illustration about American

Investing in Gold

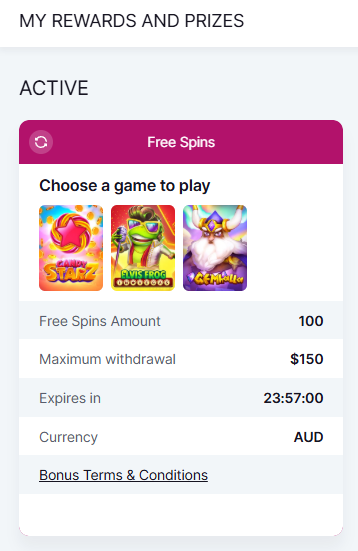

Investing in gold coins is one of the most reliable ways to diversify your investment portfolio while hedging against inflation and economic uncertainty. Unlike stocks or bonds, precious metals like gold have maintained their value for centuries, making them a cornerstone of precious metals investing. Among the most sought-after options are bullion coins such as the American Gold Eagle, American Buffalo, and Canadian Royal Mint’s Gold Maple Leaf, all of which are minted by government-backed institutions like the US Mint and Perth Mint. These coins are not only highly liquid but also IRA eligible, meaning you can include them in a gold IRA rollover for tax advantages.

When selecting gold bullion, consider factors like purity, weight, and design. For instance, the American Eagle Proof Coins are prized for their stunning finishes and limited mintages, while the Gold Krugerrand from South Africa and Austria’s Philharmonic are renowned for their affordability and global recognition. The Britannia from the UK and PAMP Suisse bars are other top-tier choices for investors seeking both aesthetic appeal and intrinsic value. Each coin carries a gold spot price premium, but government-minted options like the Maple Leaf and American Eagle often command higher trust and resale value.

Storage is another critical aspect of gold investment. While you can keep coins at home in a secure storage solution like a safe, many investors opt for professional vaults or IRA-approved depositories to ensure maximum protection. Remember, physical gold doesn’t generate income like dividends, but its role in portfolio diversification is unmatched—especially during market downturns. Whether you’re a seasoned investor or just starting, allocating 5–10% of your assets to gold coins can provide stability and long-term growth potential.

For those interested in rare or collectible pieces, proof and special edition coins like the American Eagle Proof Coins or Perth Mint’s lunar series offer additional numismatic value. However, beginners should prioritize bullion coins with lower premiums over spot price to maximize cost efficiency. Keep an eye on global trends, as geopolitical tensions or shifts in the gold standard can significantly impact prices. By staying informed and choosing reputable mints, you can build a resilient investment portfolio that stands the test of time.

Professional illustration about American

Rare Coin Values

Rare Coin Values

When it comes to gold coins, rarity plays a huge role in determining value—far beyond just the gold spot price. Collectors and investors alike chase after limited-edition or historically significant coins, often paying premiums that dwarf their bullion content. For example, American Eagle Proof Coins from the US Mint, especially those with low mintage or unique finishes, can command prices 2-3 times higher than standard American Gold Eagle bullion coins. The same goes for vintage American Buffalo coins, where early-year issues or error strikes (like the 2006 no-edge-lettering variety) are highly sought after.

But rarity isn’t just about age or mintage numbers. Condition matters a lot. Coins graded MS-70 (perfect mint state) by PCGS or NGC can skyrocket in value. Take the Gold Krugerrand: A 1967 first-year issue in pristine condition might sell for $5,000+, while a circulated one barely tops melt value. Similarly, Maple Leaf coins from the Canadian Royal Mint with unique privy marks (like the 2007 20th-anniversary edition) or special finishes (e.g., reverse proof) are worth tracking down.

Regional rarities also hold surprising weight. The Britannia series from the UK, particularly the 2013 1-oz gold proof (only 250 minted), is a sleeper hit. Meanwhile, PAMP Suisse’s Lunar Series or Perth Mint’s Year of the Dragon coins often appreciate due to cultural demand. Even the Philharmonic, Austria’s flagship gold coin, sees spikes for special editions like the 25th-anniversary release in 2025.

For investors, blending precious metals investing with numismatic strategy can diversify your investment portfolio. Focus on:

- IRA-eligible coins (like certain American Eagle proofs) for tax advantages.

- Coins with provable scarcity (e.g., US Mint annual reports confirm low mintage).

- Secure storage solutions—rare coins lose value if damaged.

Pro tip: Watch auction trends. In 2025, a 1995-W American Eagle proof (only 30,125 made) sold for $4,200, while its bullion counterpart traded near spot. That’s the power of rarity. Whether you’re into gold bullion for portfolio diversification or hunting grails, understanding these nuances separates savvy buyers from casual stackers.

Professional illustration about Mint

Bullion vs Numismatics

When deciding between bullion and numismatic gold coins for your investment portfolio, it’s crucial to understand their distinct purposes, values, and market behaviors. Bullion coins, like the American Eagle, American Buffalo, Gold Krugerrand, or Maple Leaf, are primarily valued for their metal content, closely tracking the gold spot price. These coins are minted by government-backed entities such as the US Mint, Canadian Royal Mint, or Perth Mint, ensuring high purity (typically .9999 fine gold) and liquidity. They’re ideal for precious metals investing because they’re easy to buy/sell, often IRA eligible, and serve as a hedge against inflation or economic uncertainty. For example, the American Gold Eagle remains one of the most traded bullion coins globally, while the Britannia and Philharmonic offer sovereign guarantees from the UK and Austria, respectively.

On the other hand, numismatic coins derive value from rarity, condition, and historical significance—not just gold content. These include vintage editions, limited American Eagle Proof Coins, or artifacts like pre-1933 US gold pieces. While they can appreciate significantly over time, their prices are less tied to the gold standard and more influenced by collector demand. For instance, a rare PAMP Suisse commemorative or a high-grade Krugerrand from the 1970s might sell for multiples above its melt value. However, numismatics require expertise to authenticate and appraise, making them riskier for beginners. They’re also less liquid; selling a rare coin could take months unless you work with specialized dealers.

Here’s how to choose:

- Goal: If you’re focused on portfolio diversification and secure storage of tangible assets, bullion is the pragmatic choice. It’s straightforward, cost-effective (lower premiums over spot price), and aligns with passive gold investment strategies.

- Budget: Bullion coins like the Gold Maple Leaf or American Buffalo have lower entry costs compared to numismatics, which often require substantial capital for high-value pieces.

- Market Knowledge: Numismatics can yield higher returns, but only if you understand grading systems (e.g., PCGS/NGC scales) and historical trends. Beginners should start with bullion or hybrid options like proof coins, which blend collectibility with intrinsic value.

Storage also differs: Bullion is often stored in bulk (e.g., IRA rollover-approved depositories), while numismatics may need individual, climate-controlled protection to preserve condition. Always verify authenticity—stick to reputable sources like the US Mint or Canadian Royal Mint for bullion, and certified dealers for collectibles. Whether you prioritize liquidity or long-term appreciation, aligning your choice with financial goals is key to maximizing precious metals’ potential.

Professional illustration about American

Gold IRA Options

Gold IRA Options: Diversify with Precious Metals

When it comes to Gold IRA options, investors have a wide array of choices to diversify their retirement portfolios with precious metals. The US Mint offers some of the most popular IRA-eligible gold coins, including the American Eagle and American Buffalo, both known for their purity and liquidity. The American Eagle Proof Coins are particularly sought after by collectors and investors alike, offering both aesthetic appeal and intrinsic value. For those looking beyond U.S. options, internationally recognized coins like the Gold Krugerrand (South Africa), Gold Maple Leaf (Canadian Royal Mint), and Britannia (UK) provide additional diversification. These coins are minted with high purity standards, making them ideal for gold investment and portfolio diversification.

One of the key advantages of including gold bullion in an IRA is its ability to hedge against inflation and economic uncertainty. Coins like the Philharmonic (Austria) and PAMP Suisse bars are also popular choices, often favored for their craftsmanship and global recognition. When selecting coins for a Gold IRA rollover, it’s crucial to verify their eligibility with the IRS—most options listed here meet the required .995+ fineness standard. Storage is another critical factor; opting for secure storage through an IRS-approved depository ensures compliance and peace of mind.

For investors focused on precious metals investing, the spot price of gold plays a significant role in timing purchases. Coins like the Canadian Royal Mint’s Maple Leaf or the Perth Mint’s offerings often trade close to the gold standard spot price, making them cost-effective additions to an IRA. Whether you’re a seasoned investor or new to gold coins, understanding the nuances of each option—from liquidity to premiums—can help optimize your investment portfolio. By blending classic choices like the Krugerrand with modern favorites like the American Eagle, you can build a resilient retirement strategy anchored in tangible assets.

Professional illustration about American

Coin Grading Guide

Understanding Coin Grading for Gold Bullion and Collectibles

Whether you're investing in American Buffalo coins, American Eagle Proof Coins, or international favorites like the Gold Krugerrand or Maple Leaf, knowing how coins are graded is crucial for maximizing their value. Coin grading assesses a coin's condition on a scale from Poor (P-1) to Perfect Mint State (MS-70), with factors like wear, luster, and strike quality determining its grade. For precious metals investors, higher grades often mean higher premiums, especially for rare or limited-edition coins like those from the US Mint or Perth Mint.

Key Grading Factors to Watch

- Surface Preservation: Scratches, dings, or toning can drastically lower a coin's grade. For example, an American Gold Eagle with full original luster and no contact marks might score MS-69 or MS-70, while one with visible wear could drop to AU-58.

- Strike Quality: Coins with sharp details (like the Britannia's intricate design) command higher grades. Weak strikes—common in older bullion coins—may limit the grade even if the surface is flawless.

- Eye Appeal: Subjective but critical. A PAMP Suisse bar or Philharmonic coin with vibrant toning might appeal to collectors, while investors may prioritize pristine bullion for IRA-eligible purchases.

Grading Services and Their Role

Third-party grading services like PCGS or NGC provide unbiased assessments, encapsulating coins in tamper-proof holders with labels noting the grade. For portfolio diversification, graded coins (e.g., MS-70 American Eagle Proofs) offer liquidity and trust in resale markets. However, raw coins (ungraded) can be a cost-effective entry for those focused on gold spot price over numismatic value.

Practical Tips for Buyers

- For Investors: Stick to widely recognized bullion coins (e.g., Krugerrand, Canadian Royal Mint products) in lower grades (AU/MS-63) to avoid overpaying for perfection.

- For Collectors: Prioritize MS-65+ grades for modern rarities like Perth Mint releases, where condition drives long-term appreciation.

- Storage Matters: Even high-grade coins lose value if improperly stored. Use secure storage solutions to prevent environmental damage.

Common Pitfalls

- Overgrading: Some dealers exaggerate grades. Always verify with a magnifying tool or buy slabbed coins.

- Ignoring Market Trends: In 2025, demand for IRA rollover-friendly coins (like American Eagles) has surged, affecting premiums across grades. Stay updated on precious metals investing trends to time purchases wisely.

By mastering grading nuances, you can strategically acquire gold coins—whether for investment or collection—while avoiding costly missteps.

Professional illustration about Britannia

Historic Gold Coins

Historic Gold Coins

For collectors and investors alike, historic gold coins represent a fascinating intersection of numismatic value and precious metals investing. These coins, often minted by renowned institutions like the US Mint, Canadian Royal Mint, or Perth Mint, carry not just the intrinsic value of gold bullion but also a rich historical legacy. Take the American Gold Eagle, for example—first issued in 1986, it remains one of the most sought-after bullion coins globally, with its iconic Lady Liberty design and guaranteed gold content. Similarly, the American Buffalo, introduced in 2006, pays homage to the classic 1913 Buffalo Nickel, blending artistry with IRA-eligible investment appeal.

Beyond the U.S., coins like the Gold Krugerrand (the first modern gold bullion coin, launched in 1967 by South Africa) and the Gold Maple Leaf (known for its 99.99% purity from the Canadian Royal Mint) have cemented their places in portfolio diversification strategies. The Britannia and Philharmonic series, from the UK and Austria respectively, offer unique regional designs while maintaining the liquidity and security of gold spot price alignment. Even private mints like PAMP Suisse contribute to this market with intricately designed bars and coins, appealing to both collectors and those focused on secure storage.

What makes historic gold coins particularly compelling is their dual role as tangible assets and cultural artifacts. For instance, pre-1933 U.S. gold coins, such as the $20 Double Eagle, are prized for their rarity and connection to the gold standard era. Modern releases, like the American Eagle Proof Coins, cater to collectors with limited-edition finishes, while still serving as a hedge against inflation. Whether you’re building a long-term investment portfolio or simply appreciating the craftsmanship, historic gold coins offer a unique way to own a piece of financial history—backed by the timeless value of precious metals.

Pro tip: When evaluating historic gold coins, consider factors like mintage numbers, condition (graded by agencies like PCGS or NGC), and premium over the gold bullion price. Coins with lower mintages or iconic designs (e.g., the Krugerrand’s springbok motif) often appreciate beyond their metal content, making them standout choices for both IRA rollovers and private collections.

Professional illustration about Canadian

Modern Mint Releases

Modern Mint Releases continue to captivate both collectors and investors in 2025, offering a blend of artistic craftsmanship and tangible value. The US Mint remains a powerhouse with its American Eagle and American Buffalo series, which are IRA-eligible and highly sought after for portfolio diversification. The American Eagle Proof Coins, with their mirror-like finishes and limited mintages, are particularly prized for their aesthetic appeal and investment potential. Meanwhile, the Canadian Royal Mint’s Gold Maple Leaf stands out for its .9999 purity and iconic maple leaf design, making it a top choice for those focused on gold bullion with a touch of national pride.

Across the Atlantic, the Britannia from The Royal Mint and the Philharmonic from the Austrian Mint offer European flair, often appealing to investors looking for precious metals with historical and cultural significance. The Gold Krugerrand, minted in South Africa, remains a classic choice for its liquidity and recognition worldwide. For those who prefer smaller denominations or innovative designs, PAMP Suisse and the Perth Mint deliver exquisite bars and coins with unique themes, from lunar series to mythological motifs, blending gold investment with collectibility.

When evaluating modern mint releases, consider factors like the gold spot price, mint reputation, and IRA eligibility. For example, the American Gold Eagle is backed by the U.S. government, adding a layer of security, while the Maple Leaf’s ultra-high purity appeals to purists. Storage is another critical consideration—secure storage solutions, such as vaults or insured depositories, ensure your bullion coins remain protected. Whether you’re building an investment portfolio or adding to a collection, staying informed about annual releases, special editions, and mintage numbers can help you make smarter decisions in the dynamic world of precious metals investing.

Pro tip: Keep an eye on limited-edition releases, such as privy-marked Gold Maple Leafs or anniversary editions of the Krugerrand, as these often appreciate faster due to scarcity. Diversifying across mints and designs not only hedges against market fluctuations but also enhances the enjoyment of owning physical gold coins. Remember, while bullion coins are valued primarily for their metal content, proof and special finishes can command higher premiums over time, making them a strategic addition for long-term gold standard enthusiasts.

Professional illustration about Krugerrand

Gold Coin Storage

Here’s a detailed, SEO-optimized paragraph on Gold Coin Storage in conversational American English, incorporating your specified keywords naturally:

When it comes to gold coin storage, security and accessibility are paramount. Whether you own American Eagles, Buffalo coins, or Krugerrands, protecting your precious metals requires careful planning. For casual collectors, a home safe bolted to the floor or wall is a popular choice—just ensure it’s fireproof and rated for high-value items. However, if your portfolio includes IRA-eligible coins like the American Gold Eagle or Canadian Maple Leaf, consider professional vault storage offered by trusted providers such as Brinks or Delaware Depository. These facilities provide military-grade security, climate control, and insurance, making them ideal for bullion coins or rare proof editions.

Diversification applies to storage too. Don’t keep all your gold coins in one place. Split holdings between a bank safe deposit box (though beware access limitations) and a private depository. For internationally minted coins like the Britannia or Philharmonic, check if your storage provider accepts foreign bullion. Some investors even use geographically dispersed storage—storing Krugerrands in a Swiss vault while keeping American Buffalos stateside—to mitigate geopolitical risks.

Insurance is non-negotiable. Even if you opt for home storage, rider policies on homeowner’s insurance often cap coverage for gold bullion. Companies like Lloyd’s of London specialize in precious metals coverage, offering appraisals tied to the gold spot price. For IRA rollover holdings, the custodian typically mandates insured storage—ask about fees upfront.

Lastly, document everything. Maintain a detailed inventory (serial numbers, mint marks, photos) of coins like PAMP Suisse bars or Perth Mint issues, stored separately from the physical gold. This simplifies claims, estate planning, or audits. Remember: the goal isn’t just to hoard gold—it’s to preserve wealth intelligently.

Pro tip: If you’re new to precious metals investing, start small with US Mint or Royal Canadian Mint products before scaling up storage solutions. The market for gold coins thrives on liquidity, but only if your assets remain secure and verifiable.

Professional illustration about Maple

Counterfeit Detection

Counterfeit Detection: How to Spot Fake Gold Coins Like a Pro

With gold prices remaining strong in 2025, counterfeiters are getting craftier, making it crucial for investors to master counterfeit detection techniques—especially when buying popular coins like the American Buffalo, American Eagle, or Gold Krugerrand. Whether you're adding to your investment portfolio or diversifying with precious metals, knowing how to verify authenticity protects your gold investment. Here’s a detailed breakdown of red flags and verification methods.

1. Weight and Dimensions Matter

Every legitimate bullion coin has precise specs. For example:

- The American Gold Eagle weighs 1.0909 troy oz (33.93g) with a diameter of 32.7mm.

- The Gold Maple Leaf from the Canadian Royal Mint is 1 troy oz (31.10g) and 30mm wide.

Use a calibrated scale and calipers—deviations as small as 0.1g or 0.5mm can signal a fake. Counterfeiters often use tungsten cores (similar density to gold) but mess up dimensions.

2. Magnet Test and Edge Inspection

Gold isn’t magnetic. If a coin sticks to a strong magnet (like neodymium), it’s plated or fake. Also, examine the edge:

- American Eagle Proof Coins have reeded (ridged) edges with uniform grooves.

- Britannia coins feature micro-engraved security patterns.

Poorly defined edges or inconsistent lettering (like on Philharmonic coins) are dead giveaways.

3. Sound and Ping Tests

Real gold produces a distinct, resonant ping when struck. Fake coins (often mixed with copper or zinc) sound dull. Try this:

- Balance the coin (e.g., a Krugerrand) on your fingertip and tap it lightly with another gold coin. A high-pitched, long-ringing tone = authentic.

4. Design Details and Mint Marks

Reputable mints like the US Mint or Perth Mint use ultra-sharp strikes. Check for:

- PAMP Suisse coins: Look for the Lady Fortuna hologram.

- American Buffalo: The Native American portrait’s fine lines should be crisp, not blurred.

- Maple Leaf: The radial lines on the maple leaf should be perfectly straight.

5. Acid Tests and Sigma Machines

For advanced verification:

- Nitric acid kits (for 22k+ coins like the American Eagle) react only with base metals.

- Sigma Metalytics testers analyze conductivity—ideal for IRA-eligible coins stored in secure storage.

Pro Tip: Always buy from trusted dealers (like APMEX or JM Bullion) and cross-check serial numbers with mint databases. If a deal on gold bullion seems too good to be true, it probably is. Stay sharp—your portfolio diversification depends on it.

Professional illustration about Krugerrand

Selling Gold Coins

Selling gold coins can be a lucrative endeavor, especially when you understand the market dynamics and the factors that influence pricing. Whether you're looking to offload American Eagle proofs, Gold Krugerrands, or Maple Leaf bullion, knowing where and how to sell is key. In 2025, the demand for precious metals remains strong, with investors seeking portfolio diversification amid economic uncertainties. Here’s what you need to consider to maximize your returns.

First, identify the type of gold coins you own. Popular options like the American Buffalo, Britannia, or Philharmonic often command higher premiums due to their recognized purity and design. Coins from reputable mints like the US Mint, Canadian Royal Mint, or Perth Mint are highly sought after. If you have IRA-eligible coins, such as the American Gold Eagle, you might attract buyers looking for tax-advantaged investments. Rare or limited-edition pieces, like American Eagle Proof Coins, can fetch even higher prices from collectors.

Next, determine the current gold spot price, as it serves as the baseline for your coins’ value. In 2025, gold continues to be a gold standard for precious metals investing, but prices fluctuate daily. Use reputable sources to track the gold bullion market, and consider selling when prices peak. Remember, dealers will offer slightly below the spot price to cover their margins, so shop around for the best deal. Online platforms specializing in bullion coins often provide competitive rates compared to local pawn shops or jewelry stores.

Choosing the right buyer is another critical step. Established dealers, auction houses, and online marketplaces are all viable options. For high-value coins like PAMP Suisse or Krugerrand, consider auction houses that cater to serious collectors. If you’re selling in bulk, bullion dealers might offer volume discounts. Always verify the buyer’s reputation—look for reviews or certifications from organizations like the Professional Numismatists Guild (PNG). Avoid rushed transactions; take your time to compare offers.

Prepare your coins for sale to ensure you get top dollar. Clean coins improperly, and you risk damaging their value—many collectors prefer coins in their original condition. If you have original packaging or certificates of authenticity (like those from the US Mint or Canadian Royal Mint), include them to boost buyer confidence. For gold investment pieces stored long-term, check for tarnish or scratches, as these can affect resale value. Proper secure storage over the years pays off when it’s time to sell.

Finally, understand the tax implications. In 2025, selling gold coins may trigger capital gains taxes, depending on your holding period and profit. Coins held in an IRA rollover have specific rules, so consult a tax professional to avoid surprises. Documentation is key—keep records of purchase receipts, sale agreements, and any appraisals. This not only simplifies tax filing but also provides credibility if buyers question the coin’s provenance.

Whether you’re selling a single Gold Maple Leaf or an entire collection, approaching the process strategically ensures you capitalize on the enduring appeal of gold coins as a stable investment. Stay informed, choose reputable buyers, and time your sale wisely to make the most of your precious metals assets.

Professional illustration about Maple

Gold Coin Collecting

Gold coin collecting isn’t just a hobby—it’s a smart way to diversify your investment portfolio while owning tangible assets. Whether you’re drawn to the iconic American Buffalo or the globally recognized Gold Krugerrand, each coin tells a story and holds intrinsic value tied to the gold spot price. The US Mint produces some of the most sought-after coins, like the American Gold Eagle and American Eagle Proof Coins, which are not only beautiful but also IRA eligible, making them a practical choice for long-term precious metals investing.

For beginners, starting with bullion coins is a solid strategy. These coins, such as the Canadian Royal Mint’s Gold Maple Leaf or the Perth Mint’s offerings, are valued primarily for their metal content rather than rarity. Their purity (often .9999 fine gold) and recognizable designs make them easy to trade. On the other hand, seasoned collectors might focus on limited-edition releases or historic pieces, like the Britannia or Philharmonic, which carry both precious metals value and numismatic appeal.

Storage is a critical consideration. Unlike stocks or bonds, gold bullion requires secure storage to protect against theft or damage. Options range from home safes to professional vaults, but if you’re holding IRA-eligible coins, you’ll need an approved depository. Coins like the PAMP Suisse bars or the Krugerrand are popular for their liquidity, but always verify authenticity through reputable dealers to avoid counterfeits.

Diversification is key. While the American Eagle and Maple Leaf are staples, exploring coins from different mints (like the Royal Canadian Mint or Austrian Mint) can hedge against market fluctuations. Also, keep an eye on the gold standard trends—coins with higher purity or unique designs often appreciate beyond their melt value. Whether you’re buying for investment or passion, gold coin collecting blends financial savvy with the thrill of owning a piece of history.

Professional illustration about Suisse

Coin Market Trends

Here’s a detailed paragraph on Coin Market Trends in markdown format:

The gold coin market in 2025 continues to thrive as investors seek portfolio diversification and secure storage of wealth amid economic fluctuations. American Eagle and American Buffalo coins remain top choices for U.S. buyers, thanks to their IRA eligibility and trusted backing by the US Mint. Internationally, the Gold Maple Leaf (Canadian Royal Mint) and Britannia coins are gaining traction due to their refined purity and innovative anti-counterfeiting features. Meanwhile, the Krugerrand and Philharmonic maintain strong demand in Europe, appealing to collectors and investors alike for their liquidity and recognizable designs.

One notable trend is the rising popularity of proof coins, particularly the American Eagle Proof series, which combines precious metals investing with numismatic value. High-net-worth individuals are increasingly allocating funds to limited-edition releases from PAMP Suisse and Perth Mint, viewing them as both bullion and art. The spot price of gold remains a key driver, but savvy buyers are also paying attention to premiums over melt value—especially for government-minted coins like the Gold Krugerrand, which often trade at tighter spreads compared to private mint offerings.

For those considering gold investment, 2025 presents unique opportunities. The market has seen a surge in IRA rollover activity into physical gold, with financial advisors emphasizing the role of bullion coins in hedging against inflation. Smaller denominations (e.g., 1/10 oz coins) are outpacing larger bars in sales volume, reflecting retail investors’ preference for flexibility. Meanwhile, institutional players are stacking American Gold Eagles and Canadian Royal Mint products, drawn by their liquidity in secondary markets.

A word of caution: while gold’s gold standard reputation endures, newcomers should research storage solutions (e.g., vaults vs. home safes) and avoid overpaying for "collector" labels unless they understand the niche. Stick to widely recognized coins like the Maple Leaf or American Buffalo for core holdings, and explore specialty pieces (e.g., Perth Mint lunar series) only after building a foundation. The takeaway? The coin market isn’t just about gold spot price—it’s about balancing rarity, liquidity, and institutional trust in your investment portfolio.

Professional illustration about Perth

Gold Coin Appraisals

Getting an accurate gold coin appraisal is crucial whether you're buying, selling, or insuring your precious metals collection. The value of coins like the American Buffalo, American Eagle, or Gold Krugerrand depends on factors like rarity, condition, and the current gold spot price. For example, a 2025 American Eagle Proof Coin in pristine condition could fetch a premium over its bullion counterpart due to its limited mintage and craftsmanship. Meanwhile, a well-worn Maple Leaf might be valued closer to its melt value unless it's a rare vintage.

When appraising gold bullion coins, start by verifying authenticity. Coins from reputable mints like the US Mint, Canadian Royal Mint, or Perth Mint typically have distinct hallmarks and precise weights. Counterfeits are a growing concern, especially for high-demand coins like the Britannia or Philharmonic. Use a magnifying glass to check fine details—the American Gold Eagle, for instance, should have sharp reeding on the edges and a flawless strike.

For investment-grade coins, consider professional appraisal services. Many dealers and auction houses offer certified appraisals, particularly for IRA-eligible coins like the Gold Krugerrand or PAMP Suisse bars. These appraisals often include a graded assessment (e.g., MS-70 for flawless coins) and documentation for portfolio diversification purposes. If you’re planning an IRA rollover, a certified appraisal ensures compliance with IRS regulations.

Storage conditions also impact value. Coins stored in secure storage with anti-tarnish capsules retain higher grades. A Gold Maple Leaf kept in its original mint packaging will typically appraise higher than one exposed to humidity or handling. For collectors, provenance matters—coins with documented histories or original receipts from mints like the Perth Mint or US Mint can command premiums.

Finally, stay updated on market trends. While the gold standard no longer backs currencies, global demand for bullion coins as a hedge against inflation keeps prices volatile. In 2025, geopolitical tensions and central bank policies are driving interest in precious metals investing, so regular reappraisals are wise. Whether you hold American Eagle Proof Coins or Krugerrands, understanding these nuances ensures you maximize returns on your gold investment.

Professional illustration about Philharmonic

Coin Cleaning Tips

Coin Cleaning Tips for Protecting Your Precious Metals Investment

When it comes to gold coins like the American Eagle, American Buffalo, or Gold Maple Leaf, proper cleaning is crucial—but it’s also a delicate process. Many collectors and investors make the mistake of over-cleaning, which can damage the coin’s surface and reduce its numismatic or investment value. Here’s what you need to know to keep your bullion coins in pristine condition without compromising their integrity.

First, understand when cleaning is (and isn’t) necessary. Coins like the American Eagle Proof Coins or Britannia are often sealed in protective cases by the US Mint or Canadian Royal Mint, meaning they shouldn’t require cleaning. However, if you own gold bullion coins stored outside of capsules (e.g., Krugerrand or Philharmonic), gentle maintenance may be needed to prevent tarnishing or dirt buildup.

The golden rule? Never use harsh chemicals or abrasives. Dish soap, baking soda, or commercial jewelry cleaners can scratch the surface or strip the coin’s luster. Instead, opt for a mild, pH-neutral soap diluted in distilled water. Soak the coin for a few minutes, then rinse it under lukewarm water—never hot, as extreme temperatures can affect the metal. Pat dry with a microfiber cloth to avoid streaks.

For stubborn residues, consider a specialized precious metals cleaning solution designed for gold coins, such as those used by professional conservators. Brands like PAMP Suisse and Perth Mint sometimes offer proprietary cleaning kits for their products. Always test any cleaner on a less valuable coin first.

Storage is just as important as cleaning. After cleaning, place your coins in acid-free flips or airtight capsules to prevent oxidation. Avoid PVC-based holders, which can release harmful gases over time. If you’re holding IRA-eligible coins like the American Gold Eagle, proper storage is critical to maintaining their tax-advantaged status.

Pro tip: Handle with care. Always hold coins by the edges to minimize fingerprints, which contain oils that can accelerate tarnishing. For high-value pieces like Gold Krugerrand or Maple Leaf coins, wear cotton gloves during handling.

Remember, over-cleaning can decrease a coin’s value, especially for collectibles. If you’re unsure, consult a professional conservator or your precious metals investing advisor. The goal isn’t perfection—it’s preserving your portfolio diversification assets for long-term growth.

For investors tracking the gold spot price, maintaining your coins’ condition ensures they retain both their gold standard purity and resale potential. Whether you’re prepping for an IRA rollover or simply safeguarding your bullion, these tips will help you protect your hard assets without unnecessary risk.