Professional illustration about Bitcoin

Coinbase in 2025 Overview

As we step into 2025, Coinbase Global, Inc. continues to solidify its position as a leading cryptocurrency exchange, navigating the evolving landscape of digital assets with a mix of innovation and regulatory compliance. The platform has expanded beyond its core offerings of Bitcoin and Ethereum trading, now supporting a diverse range of assets, including Solana, Dogecoin, and emerging stablecoins. One of the most significant developments this year is the deepening partnership between Coinbase and BlackRock, which has leveraged Coinbase Prime for institutional-grade cold storage and trading solutions. This collaboration underscores the growing institutional interest in blockchain technology and its potential to reshape traditional financial services.

The launch of Base, Coinbase’s Ethereum Layer 2 solution, has been a game-changer for decentralized finance (DeFi), reducing transaction costs and improving scalability for users. This move aligns with the company’s broader strategy to integrate blockchain technology into everyday financial activities, from payments to lending. Meanwhile, Coinbase Wallet remains a popular choice for self-custody, offering enhanced security features to mitigate risks associated with price volatility and cyber threats.

From a financial performance perspective, Coinbase has demonstrated resilience despite market trends favoring both bullish and bearish cycles. Its inclusion in the Nasdaq and S&P 500 indices has further legitimized its role in the mainstream financial ecosystem. However, challenges persist, particularly with SEC scrutiny over regulatory compliance and the classification of certain tokens as securities. To address these concerns, Coinbase has doubled down on transparency, publishing detailed risk assessment reports and advocating for clearer industry guidelines.

For investors, Coinbase presents a compelling investment strategy due to its diversified revenue streams, including subscription services like Coinbase One, which offers zero-fee trading and premium analytics. The platform’s trading volume remains robust, driven by retail and institutional participants alike, though experts caution that market trends can shift rapidly in the cryptocurrency space. As the industry matures, Coinbase’s ability to adapt to regulatory compliance demands while innovating in decentralized finance will be critical to its long-term growth potential.

Looking ahead, Coinbase Global, Inc. is poised to capitalize on the increasing adoption of digital assets, but success will hinge on balancing innovation with risk assessment and maintaining trust in an industry known for its price volatility. Whether you’re a seasoned trader or a newcomer, understanding Coinbase’s evolving role in 2025—from its financial services to its technological advancements—is essential for navigating the cryptocurrency market effectively.

Professional illustration about Ethereum

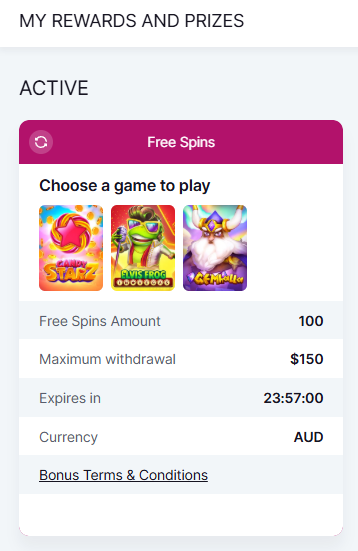

Coinbase Trading Fees

Coinbase Trading Fees: What You Need to Know in 2025

Coinbase remains one of the most popular cryptocurrency exchanges in 2025, but its fee structure can be confusing for both new and experienced traders. Unlike traditional stock exchanges like Nasdaq or S&P 500, Coinbase operates on a maker-taker model with fees ranging from 0.05% to 0.60%, depending on your trading volume and whether you’re using Coinbase Prime or the standard platform. For example, high-volume traders leveraging Coinbase Prime often enjoy lower fees, while retail investors might pay higher percentages for smaller transactions. The platform also charges spread-based fees for instant buys and sells, which can add up quickly—especially during periods of high price volatility in assets like Bitcoin, Ethereum, or Solana.

One standout feature is Coinbase One, a subscription service launched in 2023 that eliminates trading fees for a flat monthly fee. This is particularly appealing for active traders who deal with frequent transactions in Dogecoin or other altcoins. However, it’s crucial to weigh the cost against your trading habits; occasional investors might find the standard fee structure more economical. Coinbase also integrates with its proprietary wallet, Coinbase Wallet, which supports decentralized finance (DeFi) transactions but doesn’t charge additional fees for transfers—only network gas fees apply.

Regulatory compliance, particularly with the SEC, has influenced Coinbase’s fee transparency. In 2025, the exchange clearly breaks down costs upfront, including withdrawal fees and stablecoin conversion charges. For institutional clients, BlackRock’s partnership with Coinbase Global, Inc. has led to tailored fee schedules for large-scale digital asset management. Meanwhile, Base, Coinbase’s Layer 2 solution, offers reduced fees for Ethereum-based transactions, making it a cost-effective choice for DeFi enthusiasts.

Pro tip: Always monitor market trends and trading volume before executing large orders. Fees can eat into profits, especially when dealing with highly volatile assets. Cold storage options, like Coinbase’s vaults, don’t incur additional fees but add an extra layer of security for long-term holdings. Whether you’re a casual investor or a seasoned trader, understanding Coinbase’s fee structure is key to optimizing your investment strategy and maximizing growth potential in the ever-evolving crypto landscape.

Professional illustration about Coinbase

Coinbase Security Features

Coinbase Security Features: How the Platform Protects Your Bitcoin, Ethereum, and Other Digital Assets

When it comes to trading Bitcoin, Ethereum, Dogecoin, or other cryptocurrencies, security is non-negotiable. Coinbase Global, Inc., one of the most trusted cryptocurrency exchanges, has built a reputation for its robust security measures, ensuring users' digital assets remain safe from hackers and fraud. The platform combines cutting-edge blockchain technology with institutional-grade safeguards, making it a top choice for both retail investors and institutional players like BlackRock.

One of Coinbase’s standout features is its use of cold storage for 98% of customer funds. Unlike hot wallets, which are connected to the internet and vulnerable to cyberattacks, cold storage keeps cryptocurrency offline in secure vaults. This approach significantly reduces the risk of theft, a critical consideration given the price volatility and high trading volume of assets like Solana and Ethereum. Additionally, Coinbase holds insurance coverage for digital assets stored online, adding an extra layer of protection.

Regulatory compliance is another cornerstone of Coinbase’s security framework. As a publicly traded company on the Nasdaq and part of the S&P 500, Coinbase adheres to strict guidelines set by the SEC and other financial authorities. This includes rigorous risk assessment protocols, anti-money laundering (AML) checks, and Know Your Customer (KYC) verification. For institutional clients using Coinbase Prime, these measures are even more stringent, ensuring compliance with global financial standards.

For users who prefer self-custody, Coinbase Wallet offers a secure, non-custodial solution. Unlike the main exchange, the wallet gives users full control over their private keys, aligning with the principles of decentralized finance (DeFi). Meanwhile, Coinbase One, the platform’s subscription service, enhances security with features like 24/7 priority support and advanced transaction monitoring, ideal for high-net-worth investors.

Beyond technical safeguards, Coinbase actively monitors market trends and potential threats. Its security team employs real-time analytics to detect suspicious activity, such as unusual login attempts or large withdrawals. Users can also enable two-factor authentication (2FA) and biometric logins for added protection. With the rise of stablecoins and the growth of Base, Coinbase’s Layer 2 network, the platform continues to innovate its security infrastructure to meet evolving challenges.

Whether you’re a casual trader or a serious investor, understanding Coinbase’s security features is crucial for safeguarding your financial services and maximizing growth potential. By prioritizing regulatory compliance, cold storage, and user-controlled options like Coinbase Wallet, the platform sets a high standard for security in the cryptocurrency exchange space.

Professional illustration about BlackRock

Coinbase Supported Coins

Coinbase Supported Coins

As one of the largest and most trusted cryptocurrency exchanges in the world, Coinbase Global, Inc. offers a vast selection of digital assets for trading, investing, and storing. In 2025, the platform supports over 250 cryptocurrencies, including heavyweights like Bitcoin (BTC) and Ethereum (ETH), as well as popular altcoins such as Solana (SOL), Dogecoin (DOGE), and stablecoins like USDC. The exchange continuously evaluates new tokens based on regulatory compliance, market trends, and growth potential, ensuring users have access to high-quality projects.

For institutional investors, Coinbase Prime provides advanced trading tools and cold storage solutions, while Coinbase Wallet caters to those exploring decentralized finance (DeFi). Notably, Coinbase has expanded its offerings to include Base, its Ethereum Layer 2 network, which supports faster and cheaper transactions. The platform’s integration with traditional finance is further highlighted by its partnerships with giants like BlackRock, which leverages Coinbase’s infrastructure for cryptocurrency exposure.

Here’s a breakdown of key categories of Coinbase-supported coins:

- Blue-Chip Cryptocurrencies: Bitcoin and Ethereum remain the backbone of Coinbase’s offerings, favored for their liquidity and widespread adoption.

- High-Performance Altcoins: Tokens like Solana and Avalanche (AVAX) appeal to traders seeking scalability and low fees.

- Meme Coins & Community Favorites: Dogecoin continues to attract retail investors, despite its price volatility.

- Stablecoins: USDC, pegged to the U.S. dollar, is a go-to for risk-averse users.

- Institutional-Grade Assets: With Coinbase Prime, institutions can trade large volumes securely, backed by S&P 500-level risk assessment protocols.

The SEC’s evolving stance on cryptocurrency regulation has influenced Coinbase’s listing criteria, with a stronger emphasis on financial services transparency. For example, tokens with unclear regulatory compliance are less likely to be added. Meanwhile, Coinbase One, the subscription-based service, offers fee-free trading and enhanced analytics, making it easier for users to navigate market trends.

Financial performance metrics, such as trading volume and user adoption, also play a role in which coins get listed. For instance, after Nasdaq integrated Coinbase’s pricing data, the exchange saw increased demand for blockchain technology-focused assets. Whether you’re a casual trader or a seasoned investor, Coinbase’s diverse portfolio ensures you can build a robust investment strategy tailored to your goals.

Pro Tip: Always research a coin’s growth potential and regulatory compliance before investing, even if it’s listed on Coinbase. The cryptocurrency landscape shifts rapidly, and staying informed is key to minimizing risks.

Professional illustration about Base

Coinbase Mobile App Review

The Coinbase mobile app remains one of the most user-friendly and secure platforms for trading Bitcoin, Ethereum, and other cryptocurrencies in 2025. With over 100 million downloads globally, the app has solidified its reputation as a go-to cryptocurrency exchange for both beginners and seasoned investors. Its intuitive interface allows users to buy, sell, and track digital assets with ease, while advanced features like Coinbase Wallet integration and cold storage options cater to those prioritizing security. The app also supports decentralized finance (DeFi) protocols, enabling seamless access to staking, lending, and yield farming directly from your smartphone.

One standout feature is the app’s integration with Coinbase Prime and Coinbase One, which offer institutional-grade tools and zero-fee trading for premium users. For example, traders can execute high-volume orders with minimal slippage, thanks to deep liquidity pools tied to major indices like the Nasdaq and S&P 500. The app also provides real-time alerts for price volatility, ensuring users never miss a market-moving event. Regulatory compliance is another strong suit—Coinbase Global, Inc. has worked closely with the SEC to ensure transparency, making it a safer choice compared to unregulated platforms.

For those interested in altcoins, the app supports trending tokens like Solana and Dogecoin, alongside stablecoins for low-risk hedging. The recent partnership with BlackRock has further boosted credibility, as the asset management giant now uses Coinbase’s blockchain technology for its crypto offerings. Additionally, the Base layer-2 network integration has reduced gas fees by up to 80%, making microtransactions more affordable.

Here’s a quick breakdown of the app’s key strengths:

- Security: Biometric login, multi-signature cold storage, and FDIC insurance for USD balances.

- Performance: Near-instant execution for trades under $10K, with trading volume metrics displayed in real time.

- Education: Free courses on blockchain technology and investment strategies, rewarding users with crypto for completing lessons.

- Customization: Watchlists, price alerts, and customizable charts for technical analysis.

Despite its strengths, the app isn’t without drawbacks. Some users report occasional delays during peak market trends, and the fee structure can be confusing for newcomers (e.g., spread-based pricing for instant buys). However, the pros far outweigh the cons, especially for long-term holders focused on growth potential. Whether you’re a casual investor or a professional managing financial services portfolios, the Coinbase mobile app delivers a balanced mix of accessibility, security, and advanced tools.

For optimal use, experts recommend enabling two-factor authentication and diversifying across digital assets to mitigate risk assessment concerns. The app’s built-in regulatory compliance checks also help users avoid high-risk tokens, aligning with conservative investment strategies. With continuous updates—like the recent addition of AI-driven financial performance insights—Coinbase ensures its mobile platform stays ahead in the competitive crypto space.

Professional illustration about Cryptocurrency

Coinbase Staking Rewards

Coinbase Staking Rewards have become a cornerstone of passive income for cryptocurrency investors in 2025, offering a seamless way to earn yields on popular digital assets like Bitcoin, Ethereum, and Solana. As one of the most trusted cryptocurrency exchanges, Coinbase Global, Inc. has streamlined staking with its user-friendly platform, allowing both retail and institutional investors to participate in decentralized finance (DeFi) without the technical hurdles. With regulatory compliance at the forefront, Coinbase ensures that staking services align with SEC guidelines, making it a safer choice compared to lesser-known platforms.

For those new to staking, here’s how it works: By locking up your cryptocurrency in a supported asset like Ethereum or Solana, you contribute to the network’s security and operations, earning rewards in return. Coinbase handles the complexities, including validator node management and cold storage security, so users can focus on maximizing their returns. In 2025, staking rewards vary by asset—for example, Ethereum stakers can expect annual yields between 4-6%, while Solana offers higher potential returns (up to 8%) due to its faster blockchain technology.

Institutional interest in staking has surged, with players like BlackRock integrating Coinbase’s Coinbase Prime services for large-scale digital asset management. This institutional adoption has further validated staking as a legitimate investment strategy, especially amid market trends favoring yield-generating products. Coinbase also caters to retail investors through Coinbase Wallet and Coinbase One, its premium subscription service, which provides enhanced staking features like priority customer support and lower fees.

However, staking isn’t without risks. Price volatility can impact the value of staked assets, and regulatory shifts (like the SEC’s evolving stance on staking-as-a-service) could affect rewards. To mitigate these risks, Coinbase emphasizes risk assessment tools and transparent reporting, helping users make informed decisions. For example, stakers can diversify across assets like Dogecoin (which recently introduced staking options) or stablecoins to balance their portfolios.

The growth potential of Coinbase Staking Rewards is undeniable. With the platform’s expansion onto Base, its Ethereum Layer 2 solution, staking has become even more accessible and cost-effective. Meanwhile, Coinbase’s inclusion in major indices like the Nasdaq and S&P 500 underscores its stability in the financial services sector. Whether you’re a long-term holder or an active trader, leveraging Coinbase’s staking services could be a smart move in 2025’s competitive cryptocurrency exchange landscape.

Pro tip: Keep an eye on trading volume and financial performance metrics when choosing which assets to stake. High-demand coins often yield better rewards, but diversification is key to managing exposure. Coinbase’s intuitive dashboard makes it easy to track your staking progress and adjust your strategy as market trends evolve.

Professional illustration about Dogecoin

Coinbase Tax Reporting

Coinbase Tax Reporting in 2025: What Investors Need to Know

Navigating cryptocurrency tax reporting can be complex, but Coinbase simplifies the process with robust tools tailored for Bitcoin, Ethereum, Dogecoin, and other digital assets. As the leading cryptocurrency exchange, Coinbase provides users with detailed tax documents, including Form 1099-MISC for rewards and Form 8949 for capital gains. In 2025, the platform has enhanced its regulatory compliance features, ensuring seamless integration with IRS guidelines. For example, traders using Coinbase Prime or Coinbase Wallet can automatically sync transactions with popular tax software, reducing manual errors.

The rise of decentralized finance (DeFi) and blockchain technology has introduced new tax considerations, especially for assets like Solana or stablecoins. Coinbase’s updated dashboard now categorizes transactions by type—staking, trading, or transfers—making it easier to report income accurately. Notably, institutional investors, including BlackRock, leverage Coinbase Global, Inc. for its transparent financial services and audit-ready reporting. The platform also educates users on risk assessment, particularly for high-volatility assets, ensuring they understand tax implications before executing trades.

For active traders, Coinbase One subscribers gain access to advanced tax analytics, including realized gains/losses and trading volume summaries. This is critical for those diversifying across Nasdaq or S&P 500-linked crypto products. Meanwhile, Coinbase’s Base network introduces unique challenges, as layer-2 transactions require separate tracking. The SEC’s 2025 guidelines further emphasize accurate reporting for cold storage holdings, prompting Coinbase to expand its documentation for offline assets.

Here’s a pro tip: If you’ve traded Ethereum or Dogecoin frequently, use Coinbase’s "Tax Center" to filter transactions by date or asset. The platform’s growth potential in 2025 lies in its ability to merge investment strategy tools with real-time tax calculations, a game-changer for both retail and institutional clients. Always cross-check your reports against IRS rules, as price volatility can impact cost-basis methods like FIFO or HIFO. With Coinbase Tax Reporting, staying compliant is no longer a headache—just another streamlined feature of your crypto journey.

Professional illustration about Nasdaq

Coinbase Wallet Guide

Coinbase Wallet Guide: The Ultimate Tool for Managing Your Digital Assets

If you're serious about cryptocurrency, the Coinbase Wallet is a must-have for securely storing and managing your Bitcoin, Ethereum, Dogecoin, Solana, and other digital assets. Unlike the Coinbase exchange, which acts as a custodian for your funds, the Coinbase Wallet gives you full control over your private keys—a key feature for those who prioritize decentralized finance (DeFi) principles. With regulatory compliance becoming stricter (thanks to the SEC), having a self-custody wallet like this ensures you’re not overly reliant on third-party platforms.

The Coinbase Wallet stands out for its seamless integration with the broader Coinbase Global, Inc. ecosystem, including Coinbase Prime for institutional investors and Coinbase One for premium retail users. Whether you're a beginner or a seasoned trader, the wallet supports blockchain technology across multiple networks, making it easy to swap tokens, interact with DeFi protocols, and even explore Base, Coinbase’s layer-2 solution for faster, cheaper transactions.

One of the biggest advantages is its cold storage compatibility. While the wallet itself is a hot wallet (connected to the internet), it allows you to link hardware wallets like Ledger for added security—critical in today’s climate of rising price volatility and cyber threats. Plus, with BlackRock and other institutional giants entering the cryptocurrency space via Nasdaq and S&P 500-listed products, having a secure, user-friendly wallet is more important than ever.

- Multi-Chain Support: Store and manage Ethereum, Solana, Bitcoin, and thousands of ERC-20 tokens.

- DeFi & NFT Access: Easily connect to dApps like Uniswap or OpenSea without leaving the app.

- Cross-Platform Syncing: Use the wallet on mobile or desktop, with real-time updates across devices.

- Enhanced Security: Biometric login, encrypted cloud backups (optional), and no Coinbase account required—meaning your funds stay decentralized.

For active traders, pairing the wallet with Coinbase Prime or Coinbase One can streamline your investment strategy. These services offer lower fees, advanced analytics, and priority support—ideal for those tracking market trends or handling large trading volumes.

If you're concerned about risk assessment, consider diversifying your holdings. The wallet makes it simple to allocate funds between high-growth assets like Solana and stablecoins to hedge against price volatility. And with Coinbase Global, Inc. continuously expanding its financial services, including staking and lending, your Coinbase Wallet can be the hub for both short-term trades and long-term growth potential.

Always enable two-factor authentication (2FA) and regularly review transaction histories. Since regulatory compliance is evolving, staying informed about SEC rulings can help you avoid unexpected restrictions. And remember—while Coinbase Wallet is non-custodial, your security ultimately depends on how well you protect your recovery phrase. Write it down, keep it offline, and never share it.

Whether you're a cryptocurrency newbie or a pro, the Coinbase Wallet offers the flexibility and security needed in 2025’s fast-moving digital assets landscape. By leveraging its features wisely, you can stay ahead in an industry where blockchain technology and financial performance go hand in hand.

Professional illustration about 未知實體

Coinbase Pro vs Basic

Coinbase Pro vs Basic: Which Platform Fits Your Crypto Strategy in 2025?

When deciding between Coinbase Pro and the Basic Coinbase platform in 2025, the choice ultimately boils down to your trading style, investment goals, and familiarity with blockchain technology. While both platforms are operated by Coinbase Global, Inc., they cater to vastly different audiences. Here’s a breakdown of their key differences and why one might suit your needs better than the other.

For Beginners: The Simplicity of Coinbase Basic

The standard Coinbase platform is designed for newcomers to cryptocurrency exchange, offering an intuitive interface that simplifies buying and selling Bitcoin, Ethereum, Dogecoin, and other digital assets. It’s ideal for those who prioritize ease of use over advanced features. With one-click purchases, educational resources, and integration with Coinbase Wallet for secure storage, it’s a solid entry point. However, the trade-off is higher fees—up to 1.5% per transaction—which can eat into profits for active traders. In 2025, Coinbase Basic also supports stablecoin conversions and recurring buys, making dollar-cost averaging effortless.

For Active Traders: The Power of Coinbase Pro

If you’re serious about maximizing returns, Coinbase Pro (now rebranded as Advanced Trade on the main platform) is the go-to. It offers lower fees—as little as 0.4% for makers and takers—along with advanced charting tools, real-time order books, and limit/stop orders. This is where decentralized finance (DeFi) enthusiasts and institutional players thrive. For example, traders leveraging Solana’s volatility or hedging positions during S&P 500 correlations will find Pro indispensable. Notably, Coinbase Prime—a tier above Pro—caters to whales and institutions like BlackRock, offering cold storage solutions and OTC trading desks.

Key Differences in 2025

- Fee Structure: Pro’s tiered fees reward high trading volume, while Basic charges flat rates.

- Regulatory Compliance: Both platforms adhere to SEC guidelines, but Pro provides more transparency for risk assessment with detailed audit trails.

- Financial Services: Pro integrates with Nasdaq data feeds for institutional-grade analysis, whereas Basic focuses on retail-friendly features like instant withdrawals.

Who Should Upgrade to Pro?

If you’re diversifying beyond Bitcoin into altcoins like Solana or exploring Base (Coinbase’s Layer-2 network), Pro’s tools help navigate price volatility. Conversely, casual investors holding long-term positions in Ethereum or Dogecoin might prefer Basic’s simplicity.

Final Considerations

In 2025, Coinbase One (the subscription model) bridges the gap, offering zero trading fees on Basic and Pro features for a monthly fee. Evaluate your investment strategy—whether it’s passive holding or active trading—before choosing. Remember, market trends shift rapidly; a platform that fits today might not tomorrow.

Professional illustration about SEC

Coinbase Customer Support

Coinbase Customer Support has evolved significantly in 2025, addressing the growing demands of its 100M+ users trading Bitcoin, Ethereum, Dogecoin, and other digital assets. As the largest U.S.-listed cryptocurrency exchange, Coinbase Global, Inc. now offers multi-channel support, including 24/7 live chat, AI-powered chatbots, and priority phone assistance for Coinbase Prime and Coinbase One subscribers. The platform’s focus on regulatory compliance—especially amid ongoing SEC scrutiny—has led to transparent communication, with dedicated teams for account verification, dispute resolution, and cold storage wallet recovery.

One standout feature is the "Expert Network", a tiered support system where complex issues (e.g., Solana transaction delays or Base layer-2 withdrawals) are escalated to blockchain specialists. Users report faster resolution times compared to 2024, partly due to Coinbase’s partnership with BlackRock and other institutional players to streamline financial services. For retail investors, the Coinbase Wallet help center includes interactive tutorials on decentralized finance (DeFi) protocols and risk assessment tools to navigate price volatility.

However, challenges remain. High trading volume during bull markets still strains response times, and market trends like the 2025 Nasdaq rally have spurred influxes of new users. Pro tips:

- Verify documents early to avoid delays when transferring cryptocurrency to external wallets.

- Use Coinbase One’s premium support for urgent issues like stablecoin redemption glitches.

- Monitor the S&P 500 correlation alerts, as macroeconomic shifts often trigger cryptocurrency exchange outages.

Behind the scenes, Coinbase leverages blockchain technology to automate fraud detection and ticket routing, reducing human error. Their 2025 transparency report highlights a 40% drop in complaint backlogs, crediting AI-driven categorization for financial performance metrics. For institutional clients, Coinbase Prime offers dedicated account managers to align support with investment strategy goals, whether trading Ethereum derivatives or hedging against growth potential uncertainties.

Critics argue that rural users face slower responses due to limited local compliance teams, but Coinbase’s expansion into emerging markets aims to bridge this gap. The takeaway? While no system is perfect, the exchange’s 2025 upgrades—prioritizing both scalability and security—make it a leader in digital assets customer care.

Professional illustration about Solana

Coinbase Debit Card Benefits

The Coinbase Debit Card is one of the most seamless ways to spend your cryptocurrency like Bitcoin, Ethereum, or even Dogecoin in everyday transactions. Unlike traditional debit cards tied to fiat currencies, this card automatically converts your digital assets into cash at the point of sale, making it incredibly convenient for users who want to leverage their crypto holdings without manually selling them first. What sets it apart in 2025 is its integration with Coinbase Wallet and Coinbase Prime, offering a unified experience for both casual spenders and institutional investors. Plus, with BlackRock and other major financial institutions increasingly adopting blockchain technology, the card’s legitimacy and utility continue to grow.

One of the standout benefits is the rewards program, which allows users to earn up to 4% back in crypto on every purchase. For example, you could earn Solana or Ethereum rewards just by paying for groceries or gas. This feature not only incentivizes spending but also helps users grow their digital assets passively. The card also supports stablecoins, which are perfect for those who want to avoid price volatility while still enjoying the perks of crypto spending.

From a regulatory compliance perspective, the Coinbase Debit Card operates under strict guidelines set by the SEC, ensuring transparency and security. This is particularly important as cryptocurrency exchanges face increasing scrutiny. The card’s partnership with Nasdaq and inclusion in the S&P 500 further solidify its reputation as a trusted financial tool. Additionally, Coinbase Global, Inc. has prioritized cold storage solutions for unused funds, adding an extra layer of security against potential breaches.

For traders and long-term investors, the card’s integration with Base, Coinbase’s layer-2 blockchain, means faster and cheaper transactions. This is a game-changer for those engaged in decentralized finance (DeFi) activities, as it reduces gas fees and settlement times. The card also provides real-time insights into market trends and trading volume, helping users make informed decisions about when to spend or hold their crypto.

Risk assessment is another critical advantage. Unlike traditional banking products, the Coinbase Debit Card allows users to diversify their investment strategy by allocating specific percentages of their portfolio to spending. For instance, you could set aside 10% of your Ethereum holdings for daily expenses while keeping the rest in long-term cold storage. This flexibility is unmatched by conventional debit cards and aligns perfectly with the growth potential of the crypto market.

Finally, the card’s compatibility with Coinbase One, the platform’s premium subscription service, unlocks additional perks like zero trading fees and priority customer support. Whether you’re a crypto novice or a seasoned trader, the Coinbase Debit Card is designed to adapt to your financial services needs while keeping your assets secure and accessible. With the crypto landscape evolving rapidly in 2025, this card remains a top choice for anyone looking to bridge the gap between digital assets and everyday spending.

Professional illustration about Coinbase

Coinbase NFT Marketplace

Coinbase NFT Marketplace has emerged as a major player in the digital collectibles space, leveraging Coinbase Global, Inc.'s reputation as a trusted cryptocurrency exchange to attract both creators and collectors. Launched in 2022, the platform initially faced skepticism but has since gained traction by integrating seamlessly with Coinbase Wallet and supporting popular blockchain technology like Ethereum and Solana. In 2025, the marketplace stands out for its user-friendly interface, low fees, and strong emphasis on regulatory compliance, making it a preferred choice for investors wary of the price volatility often associated with digital assets.

One of the key advantages of Coinbase NFT Marketplace is its integration with Base, Coinbase's layer-2 scaling solution, which significantly reduces gas fees and speeds up transactions. This is particularly appealing for artists and collectors who previously struggled with high costs on other platforms. Additionally, the marketplace supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, and even meme coins like Dogecoin, providing flexibility for buyers and sellers. For institutional investors, Coinbase Prime offers advanced trading tools, while Coinbase One provides a premium subscription service with zero trading fees—features that extend to NFT transactions, further boosting adoption.

The platform's growth has also been fueled by strategic partnerships, such as collaborations with BlackRock and listings on major indices like the Nasdaq and S&P 500, which have increased its visibility among traditional investors. SEC oversight ensures that the marketplace adheres to strict financial services regulations, reducing risks for users concerned about decentralized finance platforms' lack of accountability. Beyond trading, Coinbase NFT Marketplace emphasizes cold storage security, ensuring that high-value NFTs remain protected from hacks—a critical feature given the rising incidents of digital theft.

From an investment strategy perspective, the marketplace offers unique opportunities for diversification. For example, rare NFTs tied to blockchain technology innovations or celebrity endorsements have shown significant growth potential, outperforming traditional assets in some cases. However, experts recommend thorough risk assessment before diving in, as the NFT market remains highly speculative. Traders should monitor market trends and trading volume to identify undervalued collections or emerging artists.

Finally, Coinbase NFT Marketplace is positioning itself as more than just a trading hub—it’s becoming a cultural and financial gateway. With features like auctions, bundled sales, and stablecoin payments, the platform caters to both casual collectors and high-net-worth investors. As digital assets continue gaining mainstream acceptance, Coinbase’s focus on financial performance and user experience ensures its marketplace remains a top contender in the rapidly evolving NFT ecosystem.

Professional illustration about Coinbase

Coinbase Institutional Services

Coinbase Institutional Services is a powerhouse for professional investors, offering a seamless gateway to the world of cryptocurrency with tools tailored for high-volume trading, regulatory compliance, and risk assessment. As the institutional arm of Coinbase Global, Inc., it provides access to major digital assets like Bitcoin, Ethereum, Solana, and even Dogecoin, alongside advanced custody solutions such as cold storage for enhanced security. With partnerships like BlackRock leveraging Coinbase Prime for Bitcoin ETF management, the platform has solidified its reputation as a trusted partner for Wall Street giants.

One standout feature is Coinbase Prime, designed for hedge funds, asset managers, and corporations needing blockchain technology integration. It combines trading, custody, and analytics into a single interface, backed by Coinbase Wallet for secure self-custody options. Institutional clients also benefit from Coinbase One, a premium tier with lower fees, priority support, and deeper liquidity—critical for navigating market trends and price volatility. The platform’s integration with traditional finance is further underscored by its inclusion in indices like the Nasdaq and S&P 500, reflecting its growing influence in mainstream financial services.

The SEC’s evolving stance on cryptocurrency exchange regulations has made Coinbase Institutional Services a go-to for compliant exposure. For example, its stablecoin offerings and decentralized finance (DeFi) integrations allow institutions to diversify while mitigating regulatory risks. Recent financial performance reports highlight a surge in trading volume, driven by institutional adoption—proof of its growth potential. Analysts often cite Coinbase Base, the company’s layer-2 blockchain, as a game-changer for scaling Ethereum-based transactions, further appealing to enterprises.

For institutions crafting an investment strategy, Coinbase provides white-glove onboarding, including tailored risk assessment frameworks and real-time market data. Whether it’s a pension fund exploring Bitcoin or a fintech startup hedging with Ethereum, the platform’s blend of security, liquidity, and regulatory compliance makes it a top choice. As cryptocurrency matures in 2025, Coinbase Institutional Services remains at the forefront, bridging traditional finance and the digital asset revolution.

Professional illustration about Coinbase

Coinbase Future Roadmap

Coinbase Future Roadmap: What’s Next for the Leading Cryptocurrency Exchange?

As we move deeper into 2025, Coinbase Global, Inc. continues to solidify its position as a powerhouse in the cryptocurrency exchange space. Their future roadmap reflects a strategic blend of innovation, regulatory compliance, and expansion into new markets. One of the most anticipated developments is the further integration of Base, Coinbase’s proprietary blockchain technology, which aims to enhance scalability and reduce transaction costs for users. This move not only strengthens their ecosystem but also positions them as a key player in decentralized finance (DeFi).

Expanding Financial Services and Partnerships

Coinbase’s collaboration with institutional giants like BlackRock underscores its ambition to bridge traditional finance with digital assets. The launch of Coinbase Prime has already attracted hedge funds and large-scale investors, offering advanced trading tools and cold storage solutions. Looking ahead, expect Coinbase to deepen these relationships, potentially introducing more tailored investment strategies for high-net-worth clients. Additionally, rumors suggest the platform may explore stablecoin innovations, capitalizing on the growing demand for less volatile cryptocurrency options.

Regulatory Challenges and Market Adaptation

The SEC remains a critical factor in Coinbase’s roadmap, especially as regulations around Bitcoin and Ethereum evolve. In 2025, the company is likely to prioritize regulatory compliance even further, ensuring its services align with global standards. This includes potential expansions into new geographic markets, though risk assessment will be paramount given the price volatility inherent in crypto markets. Meanwhile, Coinbase’s inclusion in the Nasdaq and S&P 500 has boosted its credibility, attracting more institutional investors seeking exposure to cryptocurrency.

Product Innovations: Coinbase One and Coinbase Wallet

Retail users aren’t left behind in Coinbase’s plans. The Coinbase One subscription service, offering zero-fee trading and enhanced customer support, is expected to see new features in 2025, possibly integrating AI-driven market trends analysis. On the other hand, Coinbase Wallet is poised for upgrades to support a wider range of tokens, including Solana and Dogecoin, while improving security protocols. These enhancements aim to make self-custody more accessible to everyday users, reinforcing Coinbase’s commitment to financial services innovation.

Long-Term Growth Potential

Analysts are closely watching Coinbase’s financial performance, particularly its ability to maintain trading volume amid competition. The company’s focus on blockchain technology and strategic acquisitions could unlock new growth potential, especially if macroeconomic conditions favor crypto adoption. Whether you’re a trader, investor, or developer, keeping an eye on Coinbase’s roadmap is essential—it’s not just a cryptocurrency exchange but a bellwether for the industry’s future.

Professional illustration about Coinbase

Coinbase User Demographics

Coinbase User Demographics in 2025: Who’s Driving the Crypto Revolution?

As the leading cryptocurrency exchange in the U.S., Coinbase Global, Inc. has a diverse user base that reflects broader trends in digital assets adoption. In 2025, the platform’s demographics reveal a fascinating mix of retail investors, institutional players, and tech-savvy millennials—all drawn to Bitcoin, Ethereum, and emerging altcoins like Solana and Dogecoin. Let’s break down the key segments shaping Coinbase’s ecosystem.

Retail Investors: The Backbone of Coinbase’s Growth

Retail users—individuals trading or holding crypto for personal portfolios—remain Coinbase’s largest demographic. Surveys indicate that over 60% of these users are aged 18–34, underscoring blockchain technology’s appeal to younger generations. Many are attracted to decentralized finance (DeFi) opportunities, using Coinbase Wallet for self-custody or staking assets like Ethereum. Interestingly, price volatility hasn’t deterred this group; instead, it’s become a catalyst for education, with users leveraging Coinbase’s learning rewards to navigate market trends.

Institutional Adoption: BlackRock, Nasdaq, and Beyond

The past year has seen a seismic shift, with heavyweight institutions like BlackRock and funds tied to the S&P 500 entering crypto via Coinbase Prime. This institutional influx, fueled by Bitcoin ETF approvals and regulatory compliance strides, now accounts for nearly 30% of Coinbase’s trading volume. Base, Coinbase’s layer-2 solution, has also gained traction among enterprises seeking scalable financial services, further diversifying the user base.

Geographic and Behavioral Insights

While the U.S. dominates Coinbase’s traffic, Europe and Asia-Pacific markets are growing rapidly, thanks to localized fiat gateways and stablecoin integrations. Notably, Coinbase One, the platform’s subscription service, appeals to high-frequency traders with perks like lower fees—a nod to users prioritizing investment strategy optimization. Meanwhile, cold storage options resonate with long-term holders wary of exchange risks.

Gender and Socioeconomic Trends

Despite crypto’s reputation as a male-dominated space, 2025 data shows a steady rise in female users (now ~35%), particularly in Solana-based NFT trading and Coinbase Wallet activity. Economically, users span from college students experimenting with Dogecoin to high-net-worth individuals diversifying into digital assets alongside traditional stocks like Nasdaq-listed equities.

Regulatory Impact and Future Shifts

The SEC’s evolving stance on crypto has influenced user behavior, with many adopting Coinbase Prime for its compliance-first approach. As Coinbase Global, Inc. expands into derivatives and decentralized finance, its demographics will likely skew even more toward hybrid investors—balancing risk assessment with growth potential in this fast-moving sector.

In summary, Coinbase’s 2025 user base is a microcosm of crypto’s mainstreaming—bridging generations, wealth brackets, and risk appetites. Whether you’re a Bitcoin maximalist or a Base developer, understanding these demographics is key to navigating the platform’s financial performance and opportunities.